The pay versus performance rules require expansive new tabular disclosure of executive compensation compared to company financial performance. The rules apply to proxy and information statements for the 2023 proxy season and will require substantial planning and preparation.

Overview

The pay versus performance rules add a new table to the executive compensation disclosures required by Item 402 of Regulation S-K in which named executive officer (NEO) compensation for the five most recent fiscal years is compared to company financial performance. The table will include principal executive officer (PEO) compensation and an average of the remaining NEOs’ compensation, both as disclosed in the summary compensation table and as "compensation actually paid." Company financial performance disclosure will include total shareholder return (TSR) for the company and its peers, the company’s GAAP net income and an additional financial performance measure specified by the company as the

most important in determining executive compensation.

Also required is narrative disclosure describing the relationships between the compensation actually paid and the company financial performance measures and peer group TSR presented in the table. The disclosure must also include a tabular list of at least three, but not more than seven, financial performance measures that represent the most important financial performance measures used by the company to link company performance to the executive compensation actually paid.

Companies Subject to the Rules

All SEC reporting companies are subject to the rules, except emerging growth companies, registered investment companies and foreign private issuers. Smaller reporting companies are subject to scaled disclosure requirements that are described in more detail below.

Effective Dates and Compliance Phase-In

The new disclosure must be included in proxy and information statements that are required to include Item 402 of Regulation S-K executive compensation information for fiscal years ending on or after December 16, 2022. For most companies, the first filing that must include the new disclosure will be the proxy statement for the company’s 2023 annual meeting of shareholders.

The Pay Versus Performance Table and the related description of pay versus performance will cover the five most recently completed fiscal years. However, the first filing need only include the three most recently completed fiscal years, with one additional year included in each of the next two annual filings. Smaller reporting companies are required to provide information for the three most recently completed fiscal years, but the initial filing need only include information for the two most recently completed fiscal years.

SEC Inline XBRL requirements apply to the new disclosure, but smaller reporting companies are not required to comply with Inline XBRL requirements until the third filing in which pay versus performance information is included.

Pay Versus Performance Table

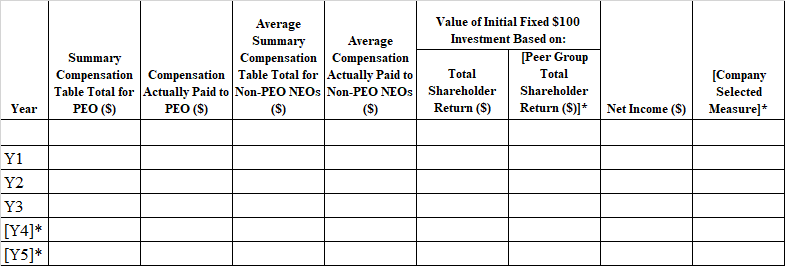

The new Pay Versus Performance Table is to be presented as follows:

*Not included for smaller reporting companies.

- TSR is calculated in the same manner as in the stock performance graph included in the Form 10-K.

- Peer group may be either the peer group used for pay decisions as disclosed in the Compensation Discussion and Analysis (CD&A) or the peer group or industry index used in the stock performance graph included in the Form 10-K.

- Net income is as reported pursuant to GAAP.

- Company selected measure that is the most important financial performance measure (in the company’s assessment) used to link compensation actually paid to company performance for the most recently completed fiscal year.

Smaller reporting companies may omit the peer group TSR and the company-selected measure from the table.

Compensation Actually Paid

For purposes of this new disclosure, "compensation actually paid" is derived from total compensation presented in the Summary Compensation Table, including a variety of adjustments intended to more closely align to value realized by executives during the year. Compensation actually paid is calculated as follows:

| |

[Total Compensation from the Summary Compensation Table] –

[Aggregate change in actuarial present value for all defined benefit plans] +

[The “service cost” and “prior service cost” for defined benefit plans] +

[Dividends or earnings paid on equity awards prior to vesting (unless reflected in fair value of the award or otherwise included in the Summary Compensation Table)] +

[Change in fair value of unvested or unearned stock and option awards (fair value at the earlier of the vesting date or the last day of the fiscal year – fair value at the later of the grant date or the last day of the prior fiscal year)].

|

|

For most companies, these adjustments will involve new calculations that are unlikely to have been made internally or disclosed publicly prior this new disclosure requirement.

Other Significant New Disclosures

The Pay Versus Performance Table must be accompanied by additional disclosure, including:

- A "clear description" of the relationships between the compensation actually paid and (1) the peer group TSR and (2) the company selected measure, as reflected in the table; and

- A tabular list of the three to seven most important financial performance measures used by the company to link compensation actually paid to company performance. If any such measure is a non-GAAP financial measure, the company must describe how the measure is calculated. If fewer than three financial performance measures were used by the company to link compensation actually paid to company performance, the tabular list must include all such measures. Companies are permitted, but not required, to include non-financial performance measures in the tabular list if they consider such measures to be among the three to seven most important performance measures and at least three (or fewer, if fewer than three financial performance measures were used) financial

performance measures have been disclosed.

Because these disclosures and the company selected measure in the table speak to the company’s "most important" pay versus performance financial measures, consideration of these metrics will be required by the company’s compensation committee, senior executives, outside compensation consultant and legal counsel.

Smaller reporting companies may omit this additional disclosure.

Implications

The new pay versus performance disclosure requirements are separate and different from the CD&A included in proxy statements, and the new required disclosure may not align with CD&A. It will be important for companies to ensure a coherent linkage between its disclosures. This may involve adding supplemental information or tables to tie disclosure together.

While creating a coherent linkage of disclosures is important, any existing pay versus performance disclosure that has historically been included in proxy statements, or new supplemental information that is added, must not obscure the new required pay versus performance disclosure, or place that disclosure in a less prominent position or otherwise mislead or confuse investors.

The new disclosure is likely to further enhance scrutiny by investors of the company’s pay versus performance link and may lead to expanded quantitative tests by proxy advisory firms in evaluating their voting recommendations. It may also increase the importance of selecting appropriate compensation peer group companies and the overall prominence of executive pay.

Next Steps

Companies should promptly take steps over the months prior to the filing of proxy statements to prepare for the new disclosure, including:

- Ensuring internal teams – in particular HR, finance, legal and IR – understand the new requirements;

- Gathering required data, determining applicable financial measures and preparing calculations of relevant numbers;

- Preparing a disclosure mock-up, which will help identify new disclosure data, sources and procedures; and

- Reviewing previously filed proxy statements to identify any past pay versus performance disclosure, comparing that disclosure to the new requirements and reconciling any conflicts or ambiguities.

Links to Resources

The following materials are available on the Securities and Exchange Commission website:

Statements by the Chair and Commissioners: