In September 2018, Ohio joined the growing number of states enacting laws to protect elderly investors from financial abuse. Last month in Cincinnati, a guilty plea was entered in a case involving criminal financial fraud on an elderly investor. The prosecution arose from a tip from the Ohio Division of Securities,1 indicating that state regulators are attuned to the problem of elder financial exploitation and are taking action.

For more than five years, the protection of retail investors—specifically seniors and those saving for retirement—has been a top priority of the SEC2 and state regulators (like Ohio). The regulators’ focus in this area is understandable, driven largely by the ever-increasing concentration of assets controlled by this demographic and the growing number of incidents of financial exploitation affecting this subsection of investors.

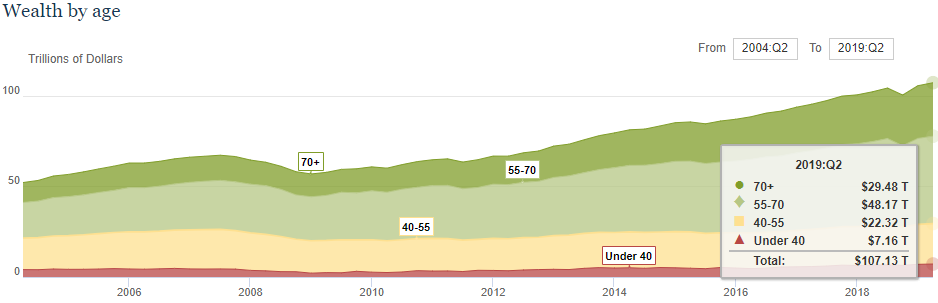

According to the U.S. Census Bureau, the number of adults over the age of 65 will outnumber the number of children under the age of 18 for the first time in U.S. history by 2034.3 Furthermore, the proportion of total U.S. wealth controlled by this investor class is astounding. The Federal Reserve Board reports that as of mid-2019, investors between ages 55-70 controlled $48.17 trillion in assets and investors 70 years or older controlled $29.48 trillion in assets, combining for more than 72% of total household wealth in the United States.4

And at a point in life when they have the most to lose, elderly persons find themselves at an increased risk of financial exploitation more than ever before. This is due to a number of factors including social and professional isolation, distance from family and caregivers, diminishing capacity from extended lifespans, and the enhanced sophistication of con artists.

In response to the growing risks of elder financial exploitation, the North American Securities Administrators Association (“NASAA”) developed Model Legislation or Regulation to Protect Vulnerable Adults from Financial Exploitation (“Model Act” or “Act”) to help state securities regulators and legislatures address

this growing need and assist financial professionals with their ongoing obligations to these types of clients. To date, the Model Act has been fully or partially adopted by 23 state and municipal jurisdictions, including four in 2019.5

In short, the Model Act mandates representatives of broker-dealers (BDs) and registered investment advisers (RIAs) be included in the class of mandatory persons who are required to report suspected elder abuse to state regulators. Specifically, it requires any individual serving as an investment adviser representative or registered rep of a broker-dealer to promptly notify state securities regulators and adult protective service agencies when the individual has a reasonable belief that financial exploitation of an “eligible adult” has

been attempted, has occurred, or is likely to occur. The definition of an “eligible adult” typically includes persons at least 65 years old or any person (regardless of age) subject to the state’s adult protective services statute.

Although not a formal adoption of the Model Act, Ohio followed a similar course in September 2018 and amended its statute to include “[a] dealer, investment adviser, sales person, or investment adviser representative licensed under Chapter 1707,” and “financial planner[s] accredited by a national accreditation agency” as mandatory reporters of known or suspected elder abuse.6 The Ohio statute appears to go even further than the Model Act by requiring not only individual personnel, but also the investment adviser or broker-dealer

firm which they represent, to report suspected elder abuse, thus creating entity-level responsibility.

Consequently, any BD or RIA doing business in the state of Ohio is required to make a report to the applicable county office of the Ohio Department of Job and Family Services when it has reasonable cause to believe an adult is being abused, neglected, or exploited.

In addition to the Ohio-specific rules governing both BDs and RIAs, broker-dealer registrants should keep in mind FINRA Rule 2165 (which allows members to place temporary holds on disbursements of funds or securities from the accounts of specified customers where there is a reasonable belief of financial exploitation of senior investors)7 and Rule 4512 (which requires members to make reasonable efforts

to obtain the name of and contact information for a trusted contact person for a customer’s account),8 which both became effective in February 2018.

With so many states adopting the Model Act or, like Ohio, a similar set of rules, BDs and RIAs must ensure they have established the proper internal controls to address when these situations occur. These policies and procedures should include basic steps on the escalation process when fraud or exploitation is detected, as well as more sophisticated controls to review account-level activity (i.e. adding a power of attorney, identifying where to send copies of financial statements, verifying the authenticity of signatures, and creating and maintaining the proper records when additional steps must be taken).

The SEC

and state securities regulators have made clear they view senior investors as a particularly vulnerable class of persons and continue to sharpen their focus on protecting this group of investors. Broker-dealers and RIAs caught without suitable training in place and established policies and procedures could suffer severe consequences.

¹https://apps2.com.ohio.gov/admn/pressroom/View.aspx?FileName=3832.pdf.

²2019 Examination Priorities, Office of Compliance Inspections and Examinations, https://www.sec.gov/files/OCIE%202019%20Priorities.pdf.

³https://www.census.gov/library/stories/2018/03/graying-america.html

4 https://www.federalreserve.gov/releases/z1/dataviz/dfa/distribute/chart/

5http://serveourseniors.org/about/policy-makers/nasaa-model-act/update/

6ORC § 5101.63.

7https://www.finra.org/rules-guidance/rulebooks/finra-rules/2165

8https://www.finra.org/rules-guidance/rulebooks/finra-rules/4512